You can face uncertain times and come out on top with the right pricing strategy. Price monitoring gives you actionable insights into the changing e-com market. When you need to monitor pricing at scale though, you will inadvertently turn to data extraction sooner or later.

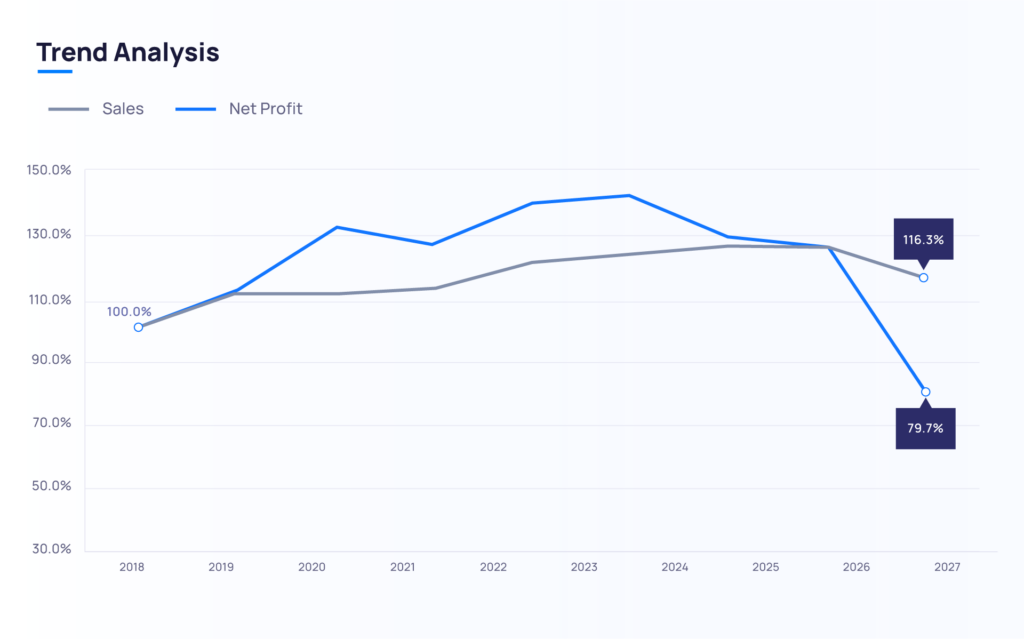

Product prices have multiple implications on the bottom line, namely sales and profits.

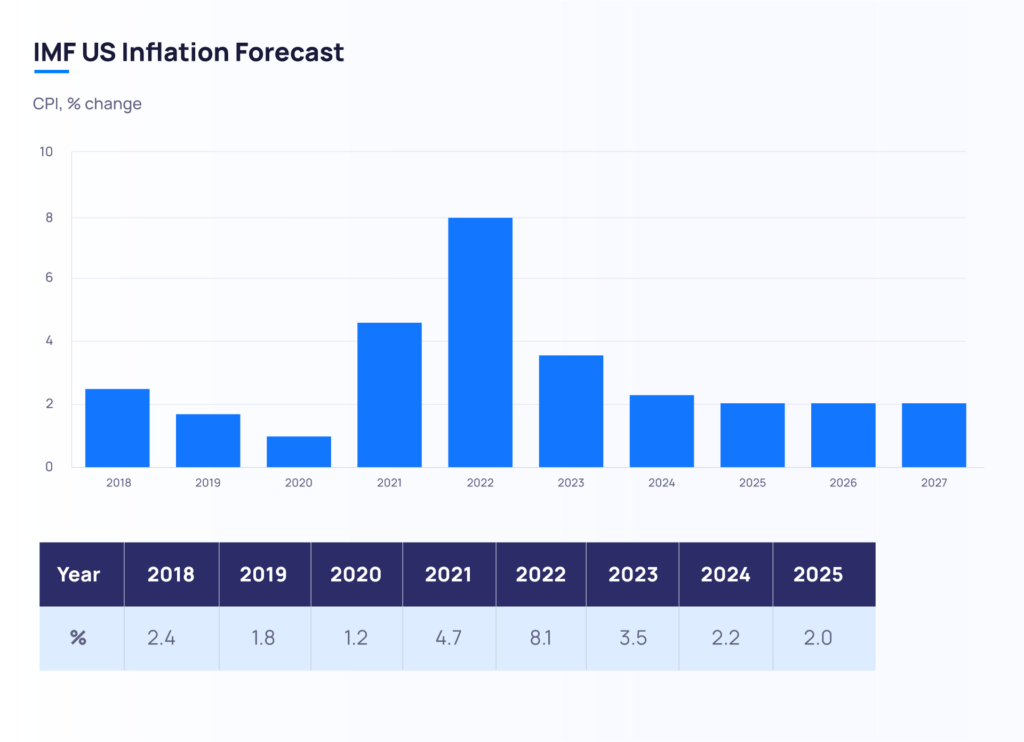

For first-time buyers, product prices hold a special significance. Even more now, in the backdrop of the widening inflation of 2022, which is continuing to deal a concerning blow to some of the world’s top economies.

The inflation has crippled buyers from purchasing consumer goods. It reached a historic high of 14.7% in the UK. The price of everyday items like toilet paper and toothbrushes hiked disproportionately.

Although the crisis forced retailers and brands to adapt to new price changes, all is not doom and gloom. Good news comes from the United States of America.

While the Consumer Price Index (CPI) inflation hit a new high of 9.1% in June 2022, the inflation-testing KPI was relatively tame for the next six months.

As for the UK, the Head of Market Analysis, Janet Mui, of the RBC Brewin Dolphin, predicts a sharp nose-dive of inflation in 2023.

The reason is the notable price drops we have seen in commodity prices like gas and oil, expansion of inventory, and fall in shipping costs.

Times may call for a more frugal take on your spending habits, but businesses now have a new card to deal with.

Pricing data will be crucial in your crusade in the e-commerce market. Whether to devise a solid e-commerce market strategy or gain digital supremacy, price monitoring with data will guide you through its ups and downs.

E-commerce brands gear up for battle in the new normal

We saw the impact of inflation first-hand in 2022’s holiday season. One study reported that many consumers were losing sleep to the rising prices. They were worried about the gifts they could not afford.

Hence, many consumers shifted to own-label products rather than branded products. A phenomenon like the shrinkflation could come into play, considering the circumstances.

E-tailers and brands need to watch the marketplace like a hawk if they want to survive in the new normal. Few trends in e-commerce are already evident, as the studies conducted by Profitero.

In 2022, Amazon led the pack in prices, offering the lowest solution for the same products. Compared to other e-marketplaces like Walmart, Target, Best Buy and The Home Depot, Amazon had an average of 13% price difference and 14 categories where it had the lowest prices.

Only in one niche category did Amazon lock horns with an online retailer catering to that very segment.

Such trends clearly show how important pricing data is to ride inflation. But, price is a very volatile matter and up-to-date information across all the major channels is key.

If you push products on all the major channels, you will most likely need an omnichannel data extraction mechanism, similar to the one Grepsr provides, to monitor pricing data.

Since the same set of keywords does not work for disparate e-marketplaces, it is also equally important to monitor different sets of keywords to measure your SOV (Share of Voice).

Why price monitoring

Pricing data is generally used by two business segments: e-tailers and consulting firms.

We can broadly classify their use-cases into two specific scenarios. E-tailers focus on understanding the micro trends in prices. Consulting firms focus on the larger picture to detect signs of massive market changes.

By collecting millions of pricing data points, you can match products throughout retailers and websites based on variables such as UPC, ASIN, GTIN, etc.

You can go on to feed this data into custom ML models to cull invaluable pricing insights.

Analyzing pricing data over time enables you to understand historical trends, or more accurately, future trends in the making.

- Retailers use pricing data to stay on the lookout for changes in price and promotions.

- Consulting firms use pricing data to monitor the overall performance of the market, and figure out beforehand if economic stressors are in the works.

Pricing data use-cases

Here are a few use cases of pricing data:

1. E-commerce competitive analysis

The e-commerce world is not a closed system. Your buyers will browse multiple categories and subcategories to look for specific products. It will bring your products face to face with your competitors.

Increasing your share of voice is only half the battle since brands and retailers compete on multiple fronts, pricing being the most consequential of them all.

Analyzing pricing data at scale will give you the insights to perform effective competitive analysis.

2. Gain actionable pricing intelligence

The application of pricing data goes beyond the analysis of your competitor’s performance. It can also help you derive insights into your own performance on e-commerce platforms.

You can track your sales goals, and align them with the insights gained from pricing data to fine-tune your e-commerce pricing strategy.

Grepsr’s pricing data solution empowers you to establish a leak-proof pricing data pipeline. This way, you will not miss out on a Black Swan pricing metric.

3. Category and subcategory standardization

Pricing data is often used interchangeably with product data and not without reason. Product descriptions, product images, and reviews and Q&A data are also equally important.

These datasets are inextricably linked to each other, and monitoring one always leads to the need to monitor another.

Grepsr provides data from various product catalogs within the categories and sub-categories of e-commerce websites in a structured format.

4. Analyze market trends

Much like the inflation-induced trends shifts we mentioned above, real-time pricing data is invaluable when it comes to scoping out trends.

Be it the holiday seasons, or inflation, many factors impact buyer behavior, which is irregular, to say the least.

Monitoring pricing data at scale will give you a sound foothold in an increasingly unstable market environment.

5. Effective repricing

The only thing more important than monitoring pricing data is acting quickly on it.

You need to be able to reprice your products with haste once the changes in your competitor’s pricing become evident. Using a repricer such as repricer.com can help you to automate your pricing and react to customer price changes instantaneously, ensuring you stay competitive.

But, then again, you will need pricing data to get started, which Grepsr has in plentiful supply.

When you opt for price monitoring with data, repricing becomes an automated process.

Get on-demand pricing data solutions with Grepsr

Owing to the extremely competitive nature of e-marketplaces, historical pricing data is almost unusable for analysis of real-time market environments.

What you need is a flexible pricing data extraction infrastructure. Grepsr’s managed data acquisition service enables you to collect millions of data points from multiple e-commerce sites.

Our manual and automated QA checks ensure the data you receive is highly actionable.

To conclude – It’s time to start price monitoring with data, if you haven’t already!

As tempting as it is to speculate about the looming recession, no one can say for certain what the future holds.

Facebook parent Meta cut 13% of its workforce, and Stripe cut 1.4%. Google has plans to let go of 12,000 of its employees. Microsoft has already laid off 10,000 employees. Amazon has announced its plans to cut more jobs, which is expected to reach up to 18,000 employees.

The sudden increase in interest rates caught tech companies off guard, leaving them incapable of dealing with uncertainty.

What feels like a premonition may become a lifeline for struggling companies. Top talent that was untouchable before is now up for hire.

Previously stagnating business models can now undergo rapid digital transformation, and punch above their weight with promising executives in their ranks. It will lead to increased competitiveness in all facets of the economy.

As inflation squeezes the purchasing power of consumers, they will look to be more discrete in their spending habits. To appeal to them, brands will need to devise new technologies, detect shopping patterns, gain a bigger share of visibility, and optimize prices continuously.

We believe in Murphy’s law, “Anything that can go wrong will go wrong.” The wisest thing to do at this point is to prepare for the worst. You can get started by leveraging actionable data.

Rather than speculating about the possibility of a recession, we recommend you begin stocking up on your ammunition by partnering with Grepsr.

Price monitoring with data is substantially effortless with us.