Big Data technologies make real estate prospecting more credible and effective by giving you access to real-time web data. You can use web scraping to gather actionable web data and analyze the real estate market environment on a city block level.

In one of the best books on investing ever written, The Intelligent Investor, Benjamin Graham introduces the readers to a fictional character by the name of Mr. Market.

Mr. Market always has an opinion on where one should invest. Sometimes, he will quote a high price for a stock, because he believes in a bright future for the business. On other days he will be terribly disheartened about the performance of a company. So, consequently, he will quote a lower price.

Graham advised against following the whims of Mr. Market because naturally, the stock market is rife with the same run-of-the-mill opinions. Success depends on your ability to detect outliers.

Enter the 2008 financial crisis, and the lessons were not heeded. The housing bubble exploded, and the entire PLS (Private Label Securities) market came crashing down. As a result, many investors lost their life savings. To Michael Burry (of the movie Big Short, a true story), the lead-up to the financial collapse was evident from the very start.

Mr. Markets from all walks of life inflated the housing market. The price of MBS (Mortgage Backed Securities) would never go down, was their combined investment narrative. Which, ultimately, led to their undoing.

Topics covered in this article:

- Real estate industry guided by web data

- Leverage Big Data to success in the ‘stable’ real estate market

- Real estate variables to consider in web data extraction

- Get started in real estate data extraction

- Application of web data extraction in real estate industry

Moving past the Great Recession: Real estate industry guided by web data?

We can’t talk about web data without mentioning analytical models that make use of this data. Particularly worrisome cases come to light when you consider the fact that the overwhelming majority of economists failed to predict the great economic downturn.

The over-reliance on mathematical models did not save the housing bubble. As computers grew more powerful, the economists came to trust complex mathematical models to figure out how economic forces will interact with each other.

Sidney G. Winter, the Touche Emeritus of Management at Wharton, pins the failure of the model on their inability to jettison certain variables that prohibit the attainment of clear-cut insights. More specifically, Professor Winter lays the blame on the algorithm’s failure to account for human psychology.

But, does web data have answers to these seemingly unanswerable questions? Indeed, for instance, a leading job board enables businesses to gauge sectors hiring the most people, and create a monitoring system that stays in touch with real-time market fluctuations.

By analyzing the number of job postings in the construction industry, you can infer the trajectory of the housing market. Furthermore, customer reviews and ratings offer a window into human psychology. So, when you are monitoring web data you are not just crunching numbers, but also analyzing qualitative data.

We do not consider web data as the solution to all your business problems, but it certainly opens the door to radical solutions.

Leverage Big Data to succeed in the ‘stable’ real estate market

What separates Big Data from other data types is its ability to provide insights in real-time. Now, you can draw conclusions from Big Data that inform your decision-making at a granular level. This way, you have a possibility to gain an upper hand before the occurrence of a crisis.

Big Data, a term coined to describe the rapid creation of web data and the technologies required to process them to gain actionable insights and inform decision-making, is characterized by four factors: Volume, Variety, Velocity, and Veracity.

Volume, concerning the exponential rise in the creation of data, and velocity has to do with the puzzling speed at which this data is created.

Web data increases by an exorbitant amount every day. Hence, Big Data technology offers ample ground to experiment with volume and variety.

Veracity is where Grepsr is most concerned with. Although we are in no short supply of data, measuring its accuracy and establishing its quality is more important than ever. Without quality data, your analysis can develop blind spots, rendering you toothless in the face of uncertainty.

Real estate firms have traditionally relied on historical data to reinforce their decision-making process. With the inception of Big Data though, they now have access to an intriguing list of variables that give much-needed insights into the threats and opportunities of a location.

The real estate variables to watch out for (In web data extraction)

Mckinsey points to an interesting observation in one of their blogs. Your common sense would probably convince you to consider just location to determine property prices. But is that all?

The greatest advantage that web scraping provides is the ability to harness web data for a more nuanced analysis of your prospect's needs and the overall real estate market in general.

Proximity to certain POI (Points of Interest) or geographic locations does affect a real estate’s price. But it's not limited to that. Turns out, property prices are affected by a mix of factors. The quantity and quality of service also inadvertently affect the equation.

For instance, having two grocery stores near your location causes an increase in mortgage prices. But, add two more in the same radius, and the property price goes down.

The rise of property prices in Boston may not always guarantee the same increase in Detroit. A host of variables come into play, from population density to proximity to special community amenities.

You can gain access to these kinds of information by collecting web data. Here are some variables you can consider for effective real estate data analysis:

- Points of Interest

- Ratings and Reviews

- Relevance of Points of Interest

- Quantity of Points of Interest

- Job Postings

- Market Performance

- Vacancy

Real estate data extraction: Where to get started

Even though the creation of data is increasing exponentially every day, getting it in a structured format is by no means an easy feat. There are endless data points available on the internet along with endless sources you can get the data from.

As a realtor you can differentiate yourself by extracting data from the following popular sources:

You can also gather information from government websites to inform your decision-making process. Perhaps you will find crucial correlations between apparently disparate variables.

But, data extraction is not as straightforward as it seems. To begin with, not all websites offer a reliable API to consistently receive the data in a structured format.

Which brings us to other enduring problems with web scraping, such as captcha solving, tackling dynamic content and automating proxy rotation, to name a few.

That is why many realtors and real estate aggregators turn to professional managed data extraction service providers like Grepsr to receive consistent high-quality data streams into their systems.

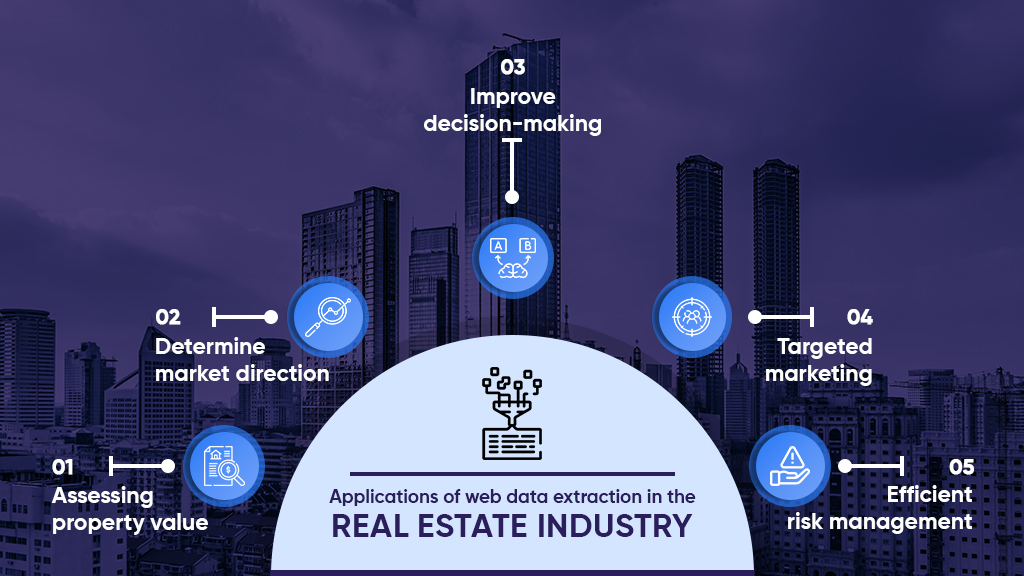

Applications of web data extraction in the real estate industry

Now, let’s get into the marrow of this article, the most palpable applications of web data extraction in the real estate industry:

1. Assessing property value

Some properties may appear low-value at first glance but can turn out to be a sound investment in hindsight. Web data is a reliable fodder to feed into Machine Learning algorithms to perform accurate predictive analytics.

In a vast real estate environment, it can be too daunting for a few variables to paint a full picture of the real ground reality.

Apart from the traditional data points like vacancy rate, home prices, market prices, and rent rates, you can leverage web data to factor in the wider market trends.

A property could be in a desirable proximity to community amenities like school, grocery stores, and hospitals, but if the crime rate in that area is high, prospective buyers would not want to move in. Thus, lowering the property’s price.

That is why it is imperative to consider wider demographic and macroeconomic indicators when it comes to appraising a property’s price.

Web data extraction enables you to gather such data at scale, and make informed decisions.

2. Determine market direction

Contrary to popular belief, and doubly proven, home prices do not always go up with time. They generally have an upward trajectory but inflationary pressures can induce unwarranted slumps in the real estate market, as we saw during the Great Recession of 2008.

Since national trends don’t always reflect on individual cities, home buyers and realtors are often advised to adopt a more extensive method to their data analysis.

Collecting different data points from various data sources can improve your decision-making, and give you a clear picture of where the overall trend is headed.

As we mentioned earlier, data points of job postings give a reliable indication of market direction. Employment preferences, pay scale, and job type are necessary data points you can factor into your data collection efforts for effective analysis.

3. Improve decision-making

We saw how you can use data to correctly assess a property's value. Moreover, we hope by now you understand how important it is to incorporate wider economic trends into your analysis.

Leveraging Big Data into your BI framework has two marked advantages.

Firstly, you get to include a variety of variables in your analysis, thus widening the scope of your research.

And, all of this happens at speed, thus allowing you to make quick and accurate decisions.

4. Highly-targeted marketing

Here’s a food for thought: Many studies have shown that millennials are holding off having kids of their own and splurging on their pets instead.

Perhaps a realtor can take advantage of this fact and focus on marketing pet-friendly property to millennials? Maybe it’s not proximity to schools, but closeness to a veterinarian clinic they are looking for in a property?

There are many insights hidden within web data, one of them being the thoughts and feelings of your prospects. Social media and discussion forum monitoring can provide a qualitative angle to your ICP (Ideal Customer Profile) build up.

Affordability is another factor you might want to consider when marketing to your customer base. Web scraping provides you with insights into your target audience’s career, interest, and lifestyle.

In an age where your customers are already sharing their wants and desires on the internet, the onus falls on real estate marketers to use Big Data technology to the best of their ability to reach out to them.

5. Effective risk management

When you are feeding real-time actionable data into your analysis, a lot of risks are naturally eliminated.

Reiterating the points expanded in the above sections, insights gained from web data helps you scientifically evaluate a property’s price under the prevailing market conditions, and improve your decision-making.

Moreover, machine learning and predictive analytics tools enable realtors and prospective home buyers to remove guesswork out of the picture and make sound judgements.

Furthermore, they can even go an extra level and extract historical data pertaining to a property’s insurance, retrofitting and inhabitation over time to further sieve through the property’s performance.

By now, you probably see a common theme emerge here. The web is a treasure trove of information. The more variables you can find for your Machine Learning algorithm, the better your risk-tolerance ability becomes.

In conclusion

Our emphasis in this article has been to stray away from the opinions propelled by Mr. Market.

Real estate market analysis has to be based on facts and figures and not on emotions and subjective thoughts.

Over-reliance on one particular model is not pragmatic either. The best way forward is walking a fine line between data and experience.

Since real-time data is already available out there on the web, we advocate the adoption of web data to inform your decision-making in the real estate industry.

To that end, web scraping data is the best way forward, for which, you can always count on Grepsr. We come with proven experience in managed data extraction, with a laudable track record of serving some of the biggest brands in the world.

Web scraping is not very straightforward. When done at scale, the technology and expertise required to account for the data volume increase as well. Grepsr takes away the hassle of you having to incur such costs. We process data in the billions, and in cases where your data requirements increase, you have nothing to worry about.

Provided you entrust your data projects on Grepsr, of course.

Perhaps the time is nigh for a new character to enter the fray — Mr. Data, anybody?